While cryptocurrency has only recently become a popular term in finance, it has been around for a long time. Before names like Bitcoin, Ethereum, and Litecoin even existed, there were attempts to create a decentralized currency.

David Chaum, a respected cryptographer, launched ECash, an anonymous system in the 1990s but it failed. Chaum built the system on currently existing government financial principles and infrastructure like credit cards. RPOW, BitGold, B-Money were also created but failed.

Cryptographers could not get past specific challenges that they faced at the time. The first challenge was how to achieve true decentralization and the second was the issue of double spending. The prevention of double spending meant the use of a third-party clearing house. This wasn’t acceptable because to achieve the type of innovative digital finance they wanted; the system had to be independent of any institution.

In 2008, cryptographers finally stumbled on the information they had been searching for when an anonymous contender released the blueprint for a digital currency known as Bitcoin. It showed the technical specifications of the blockchain — a decentralized technology that creates a trustless, permissionless system and eliminates the problem of double spending. This new technology took the world by storm, later leading to changes in the financial industry as well as other industries such as real estate. With the cryptocurrency revolution, came many coins, tokens, and altcoins. Here, we take a deep dive into the similarities and differences between some of the most popular and valued ones: Bitcoin, Ethereum, and Litecoin.

BITCOIN EXPLAINED

Bitcoin is a digital currency, created as a store of value for the anonymous exchange of goods and services online. It typically has all the properties of a more traditional currency and can be broken down into smaller parts, up to eight decimal places. It’s also the largest cryptocurrency by market capitalization.

A BRIEF HISTORY OF BITCOIN

Bitcoin first originated in 2008 when an anonymous programmer under the pseudonym of Satoshi Nakamotoreleased a paper in a cryptography mailing list. This paper detailed the workings of a new digital currency, built on blockchain technology. The virtual currency was designed to imitate key qualities of traditional money while providing anonymity, transparency and eliminating the need for a third party.

Researchers tried to find out the identity of this anonymous programmer, all to no avail. It became a mystery to the cryptography community who could not ignore this act of charity, containing a brilliant solution that had eluded them for so long.

The technology behind Bitcoin is open source, meaning that developers can modify it according to guidelines in the paper. Nakamoto aimed to create a currency that would be uniform, scarce, portable, durable and valuable, without the risk of double spending. This was achieved by creating a mathematical problem that would only ever have 21 million possible solutions. These solutions would represent Bitcoins, ensuring that only a finite amount of the currency would ever exist. This solution created scarcity, an essential property of any valuable item.

When Bitcoin was first released, it wasn’t well-known or widely accepted by the general public, and for up to eight months, it had no value. Critics laughed at the idea of a random digital currency that would be able to up-end the use of paper money as a means of exchange. However, software programmers continued to adjust the technology.

In October 2009, Bitcoin was valued for the first time when the New Liberty Standard published its exchange rate, listing the value of 1 USD to 1309.03 BTC. Soon after, in December, the second version of Bitcoin was released, and more people started spending the currency.

By the following year, exchanges had begun to pop up and, July 2010 saw the launch of MtGox, one of the largest Bitcoin exchanges. The Infamous Pizza cryptocurrency exchange also occurred in 2010, setting the precedence for other Bitcoin purchases for everyday items. It was allegedly also used to purchase illegal items and substances on the Dark web because the transactions were untraceable. The use of Bitcoin had become so popular that on February 9th, 2011, its value became equivalent to that of the US dollar.

By July 2011, 1 BTC was trading at almost 10 USD, and it continued to increase in value. As with any valuable commodity, Bitcoin began to attract theft. In March 2012, due to a security breach at Linode, almost 50,000 BTC was stolen. It was the first recorded Bitcoin crime in history. The theft would later get much worse with the loss of about 850,000 BTC from MtGox in February 2014.

Theft of Bitcoin reinforced its value in the eyes of the public, and price of Bitcoin continued to rise. Soon, several new exchanges started operating to cater to the needs of the growing horde of cryptocurrency users. It wasn’t long before groups running Ponzi schemes, pyramid schemes and different scams also began to emerge. In September 2012, a group charged with the promotion and protection of Bitcoin known as the Bitcoin Foundation was launched and since then, Bitcoin has hit many major milestones including a record value of almost $20,000 in December 2017.

HOW DOES BITCOIN WORK?

Bitcoin transactions are conducted on a public ledger known as a “blockchain.” When a user exchanges another currency for Bitcoin, the balance is kept in a Bitcoin wallet.

TRANSACTIONS

Transactions are records of value exchanges between two parties. They occur whenever a payment has been made and typically consist of four main parts:

- Output

- Input

- Hash

- Type

The output of a transaction contains information vital to the outgoing payment, usually the address that BTC is being sent to and the number of tokens being sent. The input, on the other hand, contains relevant information on where the payment is coming from, i.e., the sender’s details. The information contained in the input are:

- The hash of the incoming value (to identify the transaction)

- Incoming amount of coins

- Output index

- Sender’s address and signature.

Just like the process of sending money from one bank account to another, the output is similar to entering the account details of the receiver. The receiver would be able to view the amount sent, the transaction number, and the sender’s details. Transactions also come in various types, usually regular, reward, and fee transactions. Regular transactions are the normal exchanges that occur between two parties sending and receiving Bitcoins.

When users send coins, they pay a fee that allows that transaction to be added to the blockchain which acts as proof that the transaction indeed occurred. The process of adding transactions to the blockchain is done by a select group of people called miners.

When miners confirm new transactions by adding them to the blockchain, they’re awarded a preset amount of coins in the form of a reward transaction. This confirmation usually takes about 10 minutes for Bitcoin and attracts a fee of about $2.

BITCOIN WALLETS

Just like traditional money needs to be held in physical wallets and bank accounts to keep it safe and create accountability, Bitcoin is held in wallets. Technically, a wallet gives user ownership of a certain balance and facilitates the retrieval and transfer of coins from one address to another.

When a user exchanges fiat currency like the US dollar for BTC, it can be transferred to a wallet at a particular Bitcoin address. From this wallet, users can decide also to spend their BTC tokens which are transferred to a destination address. While wallets are commonly web-based, there are other forms of wallets which include mobile wallets, desktop wallets, and hardware wallets.

WEB-BASED WALLETS

Web wallets can be accessed from anywhere as long as a user is online via a browser. These wallets store a user’s private key online and are susceptible to hackers. It’s essential to ensure that online wallets are backed up and encrypted. This ensures that it can still be accessed by its owner even when compromised. Some notable web-based wallet providers are Coinbase, Electrum, and Blockchain.info.

DESKTOP WALLETS

Desktop wallets are better for users who prefer their wallets in a more controlled environment, rather than online. Desktop wallets store information concerning Bitcoin transactions and can be downloaded and stored on a user’s desktop. This type of wallet also allows a user to create an address as well as a private key which will be used to send and receive Bitcoin.

While desktop wallets are a good option, they have the disadvantage of being fixed in just one place. If users want to access their wallets, it can only be done on the desktop of the computer it was installed on. This dramatically limits use and can be inconvenient for users who travel or have to be away from their desktops for other reasons. Some notable desktop wallets are Armory, Multibit and Bitcoin Core.

MOBILE WALLETS

This type of wallet is usually in the form of a mobile application which can be accessed on any mobile device. Just like traditional banking apps, the owner of the mobile wallet can carry out Bitcoin transactions at any time. This is a better option for mobile users who need to make quick purchases frequently. Some mobile wallets are Bitcoin wallet and Mycelium wallet.

HARDWARE WALLETS

These wallets provide more security than any other type because they’re separated from a user’s computer, ensuring that they can’t be hacked unless they’re physically stolen. They’re usually in the form of devices which can be plugged into the USB port of a computer. Some hardware wallets like the Ledger Nano S can sign off on users’ Bitcoin transactions with their private key. They generally cost between $100 to $300 and are a better option for storing a significant amount of Bitcoins.

BITCOIN EXCHANGES

An exchange is an online destination where users trade cryptocurrency, in this case, Bitcoin. For example, if one user would like to exchange USD for BTC from another user, an exchange may be necessary to facilitate the payment. In regular exchanges, sellers usually set a minimum trade price, relative to the current BTC price against the currency they would like to trade.

This minimum price is called an ‘order’ and is entered into the exchange’s order ledger. Buyers may also set orders containing the minimum price they wish to buy BTC at. After orders have been set, the exchange matches both parties and carries out the transaction. Although Bitcoin transaction confirmation takes up to 10 minutes, the exchange instantaneously carries out the transaction.

In peer-to-peer exchanges, buyers and sellers are matched using software which allows them to carry out transactions on their own, without an intermediary to facilitate the transaction. The system is completely decentralized just like the technology, which Bitcoin itself is built on. Unfortunately, because the users on peer-to-peer exchanges are left to do their trades independently, they bear the full risk of fraud and theft.

BITCOIN BLOCKCHAIN EXPLAINED

While Bitcoin has been recognized as a modern technological advancement in the world of finance, recently, more attention has been paid to the technology behind it. This technology is known as blockchain, a ledger or record of facts. These facts can stem from terms of a contract to monetary transactions and other verification records.

The blockchain consists of several computers (nodes) in a peer-to-peer network. At every point in time, the members of this network hold the exact same copy of the blockchain which is constantly updated. Decentralized, peer-to-peer networks are not new and have been in existence for a long time. One prominent example is BitTorrent, a system that allows users to share files between each other.

HOW DOES BLOCKCHAIN TECHNOLOGY WORK?

Each block on a blockchain consists of several transactions in cryptocurrency, carried out by several users. They serve as batches of processed information, tied together chronologically. A group of people commonly referred to as miners, listen for transactions and collect them.

After collecting them, they solve a complex cryptographic puzzle to find a solution known as a proof of work. The first miner to solve the puzzle broadcasts the new block bearing the proof of work to the network which verifies the validity of that block and adds it to the blockchain. The entire process takes about 10 minutes, and whenever a block is added to the Bitcoin blockchain, a fixed reward is paid out to the miner.

Once a block has been added to the blockchain, it cannot be edited, and any changes have to be re-written in a separate block. To illustrate this point, with the use of a physical ledger, if a transaction is recorded and something about the transaction has changed, it would be a better option to write a new entry in the ledger, instead of canceling the transaction.

BLOCKCHAIN FORKS

Just as software applications get system updates, it’s possible to update a blockchain to include changes to the way it operates. Bitcoin usage is guided by software known as the Bitcoin protocol. It specifies vital principles of blockchain operation such as the size of blocks, mining process, and other technical information.

In some cases, Bitcoin developers along with miners decide to make changes to the way the blockchain is operated. Unfortunately, these changes are not always agreed upon by everyone. The result is that a group of users and miners form a new blockchain branch known as a fork. A fork can either be ‘hard’ or ‘soft’ and maintains the history of the original blockchain up until the block on which the fork occurred.

HARD FORK VS. SOFT FORK

In the case of a soft fork, the new branch is backward compatible with the old one, just like the way a Microsoft Word 2016 document can be opened in Microsoft Word 2009 application because it’s backward compatible. However, there are features of the soft fork that won’t work on the original blockchain. Hard forks, on the other hand, are not compatible with the original blockchain. Users on the old blockchain will no longer be able to interact with users on the new one.

Due to several issues, especially the size of blocks, several Bitcoin hard forks have been made. The most notable one— Bitcoin Cash— was forked on August 1, 2017. While the size of blocks in the original Bitcoin blockchain is 1MB, Bitcoin Cash has blocks the size of 8MB. Some miners argue against the move, citing reduced fees per transactions since users no longer have to pay high fees for priority mining. Other miners support the move saying that miners can now earn more in fees since there will be eight times more transactions on each block.

Users who had BTC were given the same number of Bitcoin cash tokens as long as their coins were not held on exchanges and their keys were available. So, if a user had 50 Bitcoins on the original blockchain, then they would also have 50 Bitcoin Cash after the split. Forks have since become a way to implement new properties and functions to the initial open-source Bitcoin blockchain design. Other notable Bitcoin forks are Bitcoin Gold and Bitcoin Unlimited.

LIMITATIONS OF BITCOIN BLOCKCHAIN TECHNOLOGY

While blockchain technology may inspire awe and excitement in the minds of the public, it has its flaws and complications which make its mainstream adoption for payment difficult. The following are limitations of the Bitcoin blockchain explained in detail.

TRANSACTION SPEED

It takes roughly 10 minutes to confirm a single transaction on the Bitcoin blockchain. As the user base continues to grow, it may take longer to carry out simple transactions. For example, it would not be feasible to pay for a coffee using Bitcoins as it would take 10 minutes to confirm a single payment and even more time if there are network problems or confirmation errors.

SCALABILITY

Another limitation of blockchain is the issue of scalability. The slow confirmation speeds and current technological structure of blockchain would make scalability a herculean task. This is especially problematic because the number of Bitcoin users is estimated to reach 200 million by 2024.

Each of those users may have several transactions to confirm at different times or simultaneously, and each block only takes approximately 2,400 transactions. At 2,400 transactions in 10 minutes, there is a possibility that transaction queues will pile up, making the process tiresome. Such numbers may completely overwhelm the system.

MINING

Transaction fees act as incentives for miners to add a user’s transaction to the block they’re currently mining. The fee is usually a token amount, but in some cases, problems can arise. Since Bitcoin can be broken into eight decimal places, it’s possible to make micropayments using the cryptocurrency. These micropayments can be less than the mining fee, and this constitutes a loss to users who have to make several micropayments in a short period.

Also, while mining is open to anyone, only a few people can afford the time and equipment it takes to mine Bitcoin. As a result, small groups often merge to form mining pools. The most dominant pools are based in China, and most of the computation power necessary for adding new blocks is concentrated between just two mining pools. This has somewhat made mining a centralized process.

SECURITY

Although blockchain has been proven to be secure for conducting transactions, there is speculation of its vulnerability in the face of a 51% attack. Simply put, blockchain works on the principle that if there are several conflicting versions of a blockchain being broadcast by miners, the most valid one is the longest, i.e., the one with the most work done.

If a user decides to include a double spending transaction (spending a digital token more than once), they would need to have control over 51% of the total mining computational power. This way, such a user can overpower other miners and have their version of the blockchain added to the network. For now, that problem hasn’t arisen, but theoretically, a quantum computer would be able to provide enough power to achieve this deed. Double spending can cause inflation and destroy the integrity of the blockchain.

WHY INVEST IN BITCOIN?

Since the rise in the price of Bitcoin, more investors have trooped in from all over the world to take their profitable spots in the cryptocurrency market. In fact, in March 2017, the currency already had up to 5 million unique users. This figure has continued to grow, and in December 2017 when Bitcoin hit an all-time high of almost $20,000, the number of unique users grew to over 13 million in a buying frenzy that experts have likened to the California Gold Rush of 1848.

Despite the rush to acquire Bitcoins, the general opinion is tied between viewing Bitcoin investment as a smart move and viewing it as a foolish one. On the one hand, Bitcoin is celebrated as a commodity that will continue to rise in price as the influx of new users causes increased demand. On the other hand, speculators adamantly argue that Bitcoin has no intrinsic value and therefore is not a good investment.

It’s also believed that for the currency to become mainstream, it would have to be backed by government policies, and this would bring a sense of centralization to the system. The currency and blockchain system has also been compared to a Ponzi scheme and boiler room scheme in which worthless stock was hyped to investors who eventually lost their money.

HOW TO INVEST IN BITCOIN

Despite varying public opinions, several people have made millions from investing in Bitcoin. Popular hype surrounds the favorable volatility of cryptocurrency, leading to some general confusion about how to make any money from it. There are several ways to maximize ownership of Bitcoin.

1. MARKET TRADING

Traditional “buy low and sell high” methods have been proven to work well with the cryptocurrency. Another way to invest without playing the markets is by funding Bitcoin startups through Initial Coin Offerings (ICOs).

2. INVESTING IN STARTUPS

Although the rewards can be great, it’s also extremely risky. ICO whitepapers can be immensely deceptive, and some startups end up disappearing with investors coins and leaving them with worthless products and tokens.

One recent example is the case of Modern Tech, a Vietnamese startup that raised $660 million from 32,000 investors after promising returns of 48% per month. Shortly after a series of dubious activities, the company disappeared, leaving investors confused. More scams have occurred, but none of them negate the fact that many investors have made good money from funding ICOs. It’s just important to be careful when selecting which ones to pour money into.

3. BITCOIN LENDING

Lending Bitcoin to margin traders and individuals who wish to spend their coins without touching their wallet savings can have profitable results. On average, peer-to-peer lending services yield better returns than traditional bank lending. An added advantage of partaking in this venture is that price increase of Bitcoin leads to higher returns.

Bitfinex and Poloniex are reputable exchanges with secure lending platforms. Any of these platforms can be used once an investor has created a wallet on them. Users should be careful when choosing who to lend Bitcoins to as they’re more difficult to recover when a debtor defaults on a payment.

WHO ACCEPTS BITCOIN?

The first recorded Bitcoin exchange was from a user who paid 10,000 Bitcoins for two boxes of pizza. After that, the currency was used by mostly software developers who knew how it worked.

Subsequently, it was known as a medium of exchange in illegal businesses such as drug dealing, illegally obtained ammunition, dangerous software and even child trafficking. Due to the need for anonymous, untraceable transactions by these illegal traders, a cryptocurrency like Bitcoin was a perfect choice.

However, as its popularity and user-base increase, a new wave of businesses have begun accepting the cryptocurrency as a medium of exchange.

RESTAURANTS, CAFES, AND BARS

- Bitcoin Coffee, Haydenville, MA

- Coupa Café, Palo Alto

- Curryupnow.com – 12 restaurants in San Francisco Bay Area on this platform accept Bitcoins

- Foodler – A restaurant delivery company in North America

- KFC Canada

- Old Fitzroy Pub, Sydney, Australia

- Pembury Tavern, London, England

- PizzaForCoins.com – Domino’s Pizza can be bought on the platform using Bitcoins

- Subway

- Whole Foods

INTERNET AND SOFTWARE

- ExpressVPN.com

- Grooveshark

- Intuit

- Lumfile

- Microsoft

- Namecheap

- PureVPN

- The Internet Archive

DONATIONS

- Canada State Republican Party

- Crowdtilt.com

- Fight for the Future

- Museum of the Coastal Bend, Texas

- San Jose Earthquakes (San Jose California Professional Soccer Team (MLS))

- Save the Children

- The Libertarian Party, United States

- Wikipedia

PUBLICATIONS

- Bloomberg.com

- Playboy

- Suntimes.com

- WordPress.com

DATING

- Badoo

- OkCupid

- Dream Lover

EDUCATION

- MIT Coop Store – Massachusetts Institute of Technology student bookstore

GAMING SERVICES

- BigFishGames.com

- GameStop

- Gap

- Green Man Gaming

- Humblebundle.com

- JCPenney

- Zynga

PAYMENT SERVICES

- Braintree

- Mint.com

- NCR Silver

- PSP Mollie

- SimplePay

- Stripe

TRAVEL, TOURISM, AND HOSPITALITY

- CheapAir.com

- Expedia.com

- LOT Polish Airlines, Poland

- One Shot hotel chain, Spain

- Travel.com

- Virgin Galactic

- WebJet

TICKETING AND GIFT CARDS

- Gyft

- MovieTickets.com

- Overstock

WHOLESALE AND RETAIL OUTLETS

- Alza – Largest Czech online retailer

- Etsy – An online craft purchase center

- Famsa – The largest retailer in Mexico

- i-Pmart – A Malaysian electronics online retailer

- Jeffersons Store – A streetwear retailer

- mspinc.com – A medical equipment supply retailer

- Newegg.com – Online electronics retailer

- Rakuten – A Japanese e-commerce company

- Shopify.com – An e-commerce center for multiple sellers

- ShopJoy – An Australian online gift retailer

BITCOIN SUPPLY

Miners are rewarded with 12.5 BTC for each block they add to the blockchain. The reward is halved every 210,000 blocks (roughly every four years) to ensure that supply is controlled. This allows for a gradual introduction of new coins into the system, creating balance.

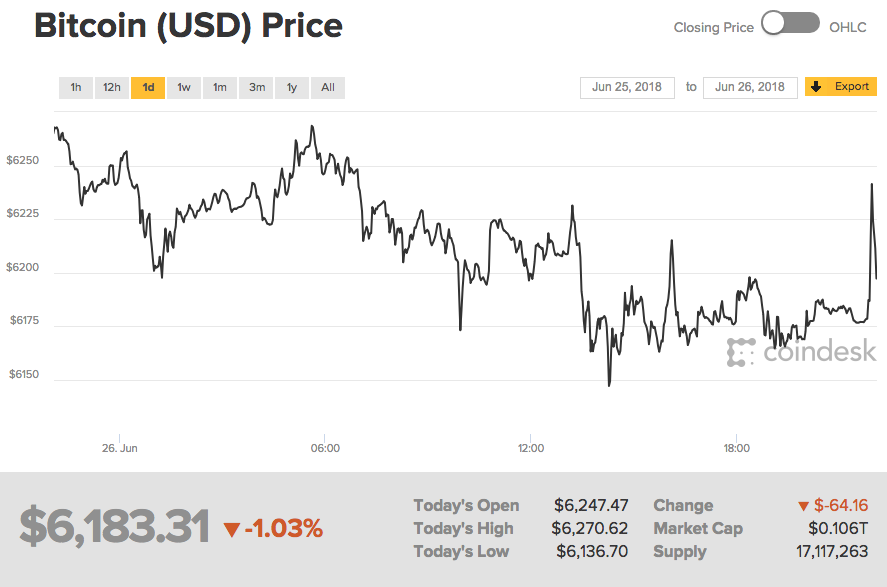

When the first block was mined, the reward paid to the miner was 50 BTC, a figure that has been halved twice already. As specified by Nakamoto in the original paper, there will only ever be 21 million Bitcoins in existence. Currently, in June 2018, over 17 million of those coins have already been mined.

After all 21 million BTC are mined, miners may no longer be incentivized to mine additional blocks. This may threaten the structure of the blockchain because if miners reduce, confirmation speeds will slow down significantly while transaction fees will most likely increase. Individuals may also hold on tightly to their Bitcoins, making it difficult for new users to get them. This will inevitably result in a BTC price increase.

BITCOIN NEWS

As the largest cryptocurrency, there has been a lot of Bitcoin news and its blockchain. A good portion of that news centers around regulations and the mainstream acceptance of BTC as a means of payment. Here are some notable Bitcoin blockchain news headlines.

- June 2018 – Bithumb, the 6th largest Bitcoin exchange was hacked with $3 million worth of cryptocurrency stolen.

- June 2018 – Bitcoin released its core version 0.16.1

WHAT IS ETHEREUM?

Ethereum is a peer-to-peer based platform on which decentralized applications can be built. Since its release in July 2015, Ethereum has risen to the top as the second largest cryptocurrency with a market cap of approximately $50 billion.

In a market flowing with thousands of cryptocurrencies, it has quickly become the topic of many debates, not just for its similarities to Bitcoin, but its differences as well. So what makes it so unique?

Ethereum was proposed in 2013 by Vitalik Buterin, a Canadian-born cryptocurrency developer. Later in 2014, it was funded via a crowd sale event in which there were 11.9 million pre-mined ETH. It was fully released in 2015 and has quickly risen since then. Ethereum tokens, known as “Ether” have become a conventional means of exchange on various blockchain-based applications and continue to grow in value.

Just like Bitcoin’s blockchain, Ethereum once had miners who also ran complex computational algorithms to get mining rewards. While these similarities exist, the currency is quite different from Bitcoin in a lot of significant ways.

HOW DOES ETHEREUM WORK?

Unlike Bitcoin, the Ethereum platform was designed in a way that allows decentralized applications (DApps) to be built on it. In fact, 1,629 applications have currently been built on its blockchain.

According to the Ethereum website, its platform is a decentralized foundation for applications that run precisely as they’re programmed. They also claim that the platform erases third parties as well as any chance of fraud or censorship. This means that ultimately, code written on its blockchain is immutable due to cryptographic technology.

Ethereum allows users to create and execute smart contracts on its platform, which form the basis of DApps. Solidity, the platform’s inbuilt programming language is used to develop these smart contracts and DApps. Ether, the ETH token, acts as their primary facilitator. For this reason, Ethereum is commonly called programmable money.

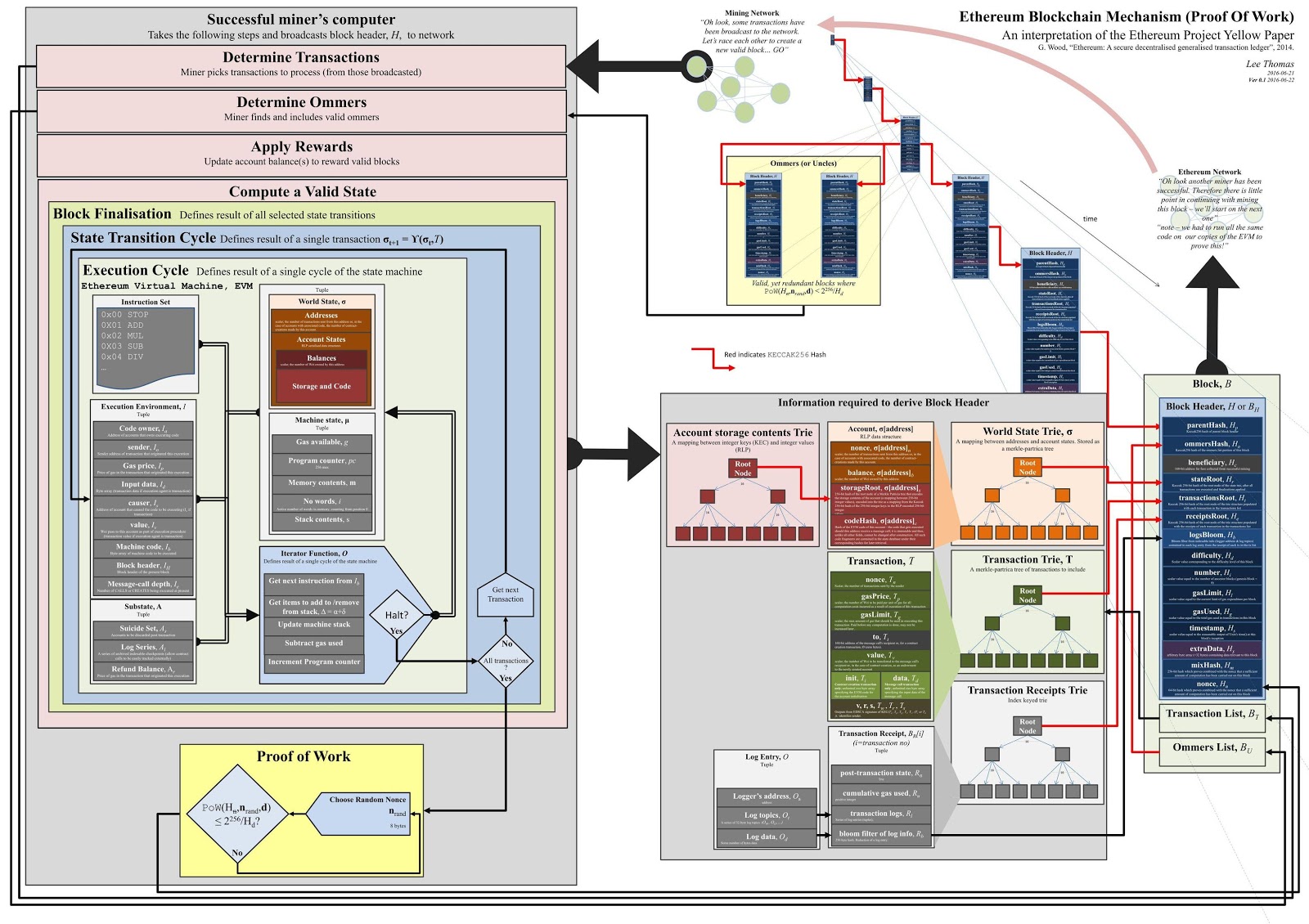

ETHEREUM BLOCKCHAIN EXPLAINED

The Ethereum blockchain consists of interlinked blocks that can hold and execute code snippets. These code snippets can be bundled together to build applications. This single quality differentiates it from Bitcoin, its immediate counterpart. Traditional applications are built to give certain outcomes when specific conditions are met, and Ethereum smart contracts do the same thing.

ETHEREUM VIRTUAL MACHINE (EVM)

The EVM is a decentralized Turing-complete machine, built to run code scripts on the Ethereum platform. It’s the particular site where all smart contracts are executed and are run by every node in the network. The virtual machine is isolated from the host computer system and makes the creation and deployment of applications possible.

DECENTRALIZED APPLICATIONS (DAPPS)

DApps are a new type of application that is not owned by a central party. They run on a peer-based network and cannot be shut down. For an application to be classed as a DApp, it must meet the following requirements:

- It must be decentralized.

- The app must have a consensus protocol in place.

- It must be open source, allowing anyone to view and contribute to its code.

- It must have digital assets to fuel its operations.

The basic structure of a DApp consists of 4 main parts:

- The blockchain

- A storage layer

- Smart contract

- Social layer

ETHEREUM BLOCKCHAIN BASED

For a decentralized application to work on Ethereum, it must be based on the blockchain. This is because peer-to-peer consensus is necessary for the validation of certain application constructs. Every node has to confirm parameters like usernames and other relevant information.

STORAGE LAYER

Currently, there are several cloud storage service providers, like AWS, that users can outsource their file storage too. Unfortunately, most of them have centralized servers and control the way that information is stored. This goes against the principles of decentralization. However, like traditional software applications, DApps need storage facilities, and for this purpose, there are decentralized storage systems like the InterPlanetary File System (IPFS).

The IPFS is a file transport protocol that can be stacked directly on the blockchain. Its working mechanism is similar to that of BitTorrent, a peer-to-peer file sharing service. IPFS is an excellent option for blockchain-based storage because instead of storing whole content, it generates a hash for each file. A hash consists of a unique combination of letters and numbers which act as a unique identifier for the file.

Files on Ethereum’s blockchain can easily be searched for on IPFS or through the use of the Ethereum blockchain explorer. To retrieve a file, a user can search for the hash of that file. To share the file with another party, a user would merely have to share that hash with the party, similar to how links to a Google document can be shared. The amount of storage space needed by DApps varies, and it would be impractical to leave the data in blocks due to the amount of space it would take.

SMART CONTRACT

A smart contract is a type of virtual contract containing written code and uploaded to the blockchain. It lives on the blockchain, usually in the form of an “if-then” statement and self-executes when the conditions specified within the contract are met. This execution is run across every node in the blockchain for confirmation.

For example, a user may want to buy in-app tokens on a game app using Ethereum. For this purchase, a smart contract is set up, specifying that if such a user pays a certain amount of Ethereum, then the game will award them a certain amount of in-app tokens.

The entire process is carried out on the blockchain and can be validated by anyone. Due to this transparency, it’s difficult to tamper with transactions on the Ethereum blockchain. One great advantage of smart contracts is that they eliminate the need for third parties. Transactions can be finalized without filling out papers, dealing with lawyers, or paying expensive processing fees.

Automation as an advantage only constitutes one side of the coin because this quality can be a huge disadvantage, too. Software programs are prone to bugs, and that’s why updated versions usually come with bug fixes. In the event of a bug occurring in a smart contract, the contract will still execute on the blockchain, and the results can be disastrous.

A recent example is the case of The DAO, a decentralized autonomous organization which served as an investment fund. Members of the organization invested Ether which bought them tokens and the right to vote on what the fund would be used for. The entire system was facilitated by a series of smart contracts, from the donation of Ether to voting and final investment.

The DAO, slated for a 28-day crowd sale, went live in April 2016 and, by the end of the funding window, it had raised $150 million from about 11,000 investors. While the Ethereum blockchain itself securely runs smart contracts, the onus lies on the independent developers of these contracts to fix all bugs.

Unfortunately, a weakness in the code was discovered by a hacker and used to drain over 3.6 million ETH into a new DAO. Since the contract merely acted as it was supposed to, the actions of the hacker were technically not illegal.

As far as traditional contracts go, context and intention are considered in a court in the event of any similar misconduct. Smart contracts, on the other hand, are made up of written code and will follow that code no matter the situation. This often strikes the question of whether the reward of smart contracts is worth the risk after all.

FUNCTIONS OF SMART CONTRACTS

There are four primary functions of Smart Contracts:

- They act as software libraries by providing certain functions to other contracts.

- Smart contracts manage ongoing contract relationships between several users. Some examples are insurance, escrow, subscriptions and other financial contracts.

- They hold and maintain data that other contracts or members of the outside world can use. For example, a smart contract may hold the protocol for a currency, membership data for certain organizations, and updated company lists.

- They act as forwarding contracts which make an access procedure more complicated by introducing additional measures. These measures usually involve sending an incoming message to a specific destination after preset conditions are met.

One example is the case of multiple ownership of a particular asset. A contract may wait until a certain number of owners have signed a message with their private keys before sending the message to others. Another example is an extra account authentication process or a contract that allows users to override a transaction limit by presenting a complicated procedure.

GAS

Each program run on the nodes of the Ethereum blockchain uses an exact amount of processing power. To conserve power and maintain the integrity of the system, it’s imperative to avoid any unnecessary activity. To regulate activity, all Ethereum programs are given a cost in gas for them to run. Gas is a measure of processing power per program in Ether. As the processing power increases, so will the amount of Ether needed to keep its contracts running.

SOCIAL LAYER

After implementing a data storage layer, and smart contract, application social constructs can be stacked on them. This is the area that users directly interact with. It contains content such as usernames, payment information, and subscription history. Depending on the application, decentralized payment platforms such as OPEN API can be added to the mix.

Together, these layers comprise the backbone of DApps. Currently, several applications exist, stretching across different industries. Some notable DApps are OmiseGo, a payment platform that uses smart contracts to offer global banking services without the need for a bank account. Another is Cryptokitties, a collectibles app making waves, especially in the art industry.

HOW TO USE ETHEREUM

To a beginner, the idea of using Ethereum and its associated applications may seem intimidating. However, it’s quite straightforward once the system becomes familiar. Ethereum has proven to be versatile, and there are different ways in which it can be used.

ETHEREUM EXCHANGE AND STORAGE

Like other cryptocurrencies including BTC, ETH has an exchange rate against other digital currencies and fiat currencies including the US dollar. This means that it’s set at a constantly fluctuating price that is affected by market forces of supply and demand.

Due to this property, Ether can be used as a store of value which can either increase and yield profits or decrease and lead to losses. Although ETH is the second largest cryptocurrency, the ETH price (currently trading at $500) is nowhere near that of BTC ($6,500). Despite this price gap, it’s possible to make a profit by buying Ethereum when the price is low and selling when high.

To store and exchange Ethereum, users must have a secure ETH wallet. Apart from storing a user’s balance, it will store private keys as well. These wallets come in the same form as Bitcoin wallets – web-based, mobile, desktop, and hardware.

It’s important to note that while the use of a wallet conveniently eliminates third-party exchanges, there is also a huge disadvantage. In the event of the loss of a private key, there is no chance of recovery and all the Ether in that wallet will be lost. Depending on the amount of Ether in a wallet, this incident can be disastrous to the user.

HOW TO BUY ETHER

To buy Ether, users can either physically locate people willing to trade or use exchanges. Exchanges help users buy ETH by matching them with other users willing to sell. Typically, on these exchanges, a user will be expected to sign up and enter any relevant details. Users may also have to exchange their traditional currency for BTC then exchange BTC for ETH because Bitcoin is more popular and it’s easier to find people willing to sell.

WHY INVEST IN ETHEREUM?

Considering the size, popularity and myriad use cases of Ethereum, there are several good reasons to invest in the cryptocurrency and a couple of solid reasons not to. 1 ETH is currently worth about $500, a considerable drop from $1,200 in January 2017. In investing, six months is enough for drastic changes to occur. If the price can fall to this level due to market volatility, a user may ask: so why should I invest in Ethereum?

The answer is simple: there is profit to be made as well. Before ETH price tanked to what it is now, it experienced a steady rise from a mere $7 in January 2017 to over $1,400 in December. So if a user had 100 ETH valued at $700 in January, the same amount of ETH would have been worth $140,000, a jaw-dropping 10,000% increase. When compared to Bitcoin which despite a peak price of almost $20,000 in the same year only saw a 1,500% increase, Ethereum is the more profitable option.

FACTORS THAT INFLUENCE ETH PRICE INCREASE

While the cryptocurrency market may seem random in its fluctuations, there are underlying factors that cause these price changes. Some of these factors have been cited continuously by various industry experts and enthusiasts in their predictions for the future of Ethereum

1. INCREASED CREATION AND INVESTMENT IN DECENTRALIZED APPLICATIONS

A good reason to invest in Ethereum is the predicted popularity of the DApps that run on it. Depending on how useful and mainstream DApps become, the price of ETH could skyrocket. This is because although each application has its crypto token associated with it, users have to exchange Ether for these tokens. All it may take is an app with the decentralized functionality of PayPal, DHL or even Pokémon Go to set a price rise in motion.

This is backed by Steven Nerayoff, the co-founder of Ethereum. On the talk show “Fast Money,” he commented that because of the amount of money being poured into the ecosystem and the apps being built, Ethereum might well surpass Bitcoin. According to him, Ethereum is currently seeing exponential growth in application projects with billions of dollars being poured into them. There are currently ten times more projects on Ethereum than there was last year and this may lead to a 2x or 3x ETH price increase by December.

In a recent Fortune interview, Alex Ohanian, the co-founder of Reddit, predicted that the price of Ether would skyrocket to $1,500 before the end of the year. He owed this prediction to the current applications on the platform and the popularity of DApps like Cryptokitties, an app which lets users buy and breed digital cats. The application recently raised $12 million in funding and has paved the way for several huge investments into other applications.

2. MAINSTREAM USE OF SMART CONTRACTS

Increased use of smart contracts built on the Ethereum platform can also influence the ETH price positively. The more users adopt smart contracts for everyday transactions including subscriptions, escrow, and even insurance, the more Ether will be spent. As smart contract usage becomes more popular, there will be more need to buy ETH to fund more smart contracts and pay “Gas.”

3. INCREASED PUBLIC ADOPTION

Ethereum usership continues to grow as there are currently 36.5 million unique addresses with about 65,000 new addresses added each day. While this may not outrightly prove that the ETH price will rise, it presents a possibility. There have also been several predictions flying about from anywhere between ETH hitting $1,000 to $20,000 in 2018.

Nigel Green, the CEO of deVere Group, made an Ethereum prediction in an interview for Marketwatch, published on April 27, 2018. Green predicts that the price of ETH may reach $2,500 by December 2018 and continue its rise through 2019 and 2020.

Olaf Wee-Carlson, the CEO of Polychain Capital, stated recently that the applications of Ethereum could be likened to Sci-fi. According to Carlson, Ethereum and its interesting applications are beyond reasonable imagination, and he would like to see how the technology progresses.

4. ADOPTION OF DECENTRALIZED FILE STORAGE BY LARGE CORPORATIONS

The creation of data globally continues to increase, prompting the need for reliable data storage methods. Humans are currently creating data at an alarming rate. According to a recent report by the International Data Center, digital data will have a compound annual growth rate of 42% through to 2020. In fact, data growth between 2010-2020 will be 50 times what it was before 2010. IBM has also reported that every day, about 2.5 exabytes (quintillion or 2.5 x 10^21 bytes) of data is created by humans.

These are mind-boggling figures that present a need to store data in a way that it cannot be taken down or lost by a single centralized server. This was the case of the popular Geocities sites taken down by Yahoo. If the data from the sites had been stored on a decentralized platform, it would have been preserved. This is where decentralized file storage clients like Storj and IPFS come in.

These storage clients are slowly being adopted by individuals and corporations and may soon become mainstream. Storj reported that the platform already has about 20,000 users. SIA, another storage platform was valued at $250 million in 2017. When large corporations adopt the use of applications like these, the influx of Ether into the system can immensely impact its price. The more people buy ETH, the more its price will increase.

FACTORS THAT INFLUENCE ETH PRICE DECREASE

Just as there are factors that increase the price of ETH, they’re other negative factors that any Ethereum investor should be wary of. The damage done by these factors will largely depend on their frequency and progression. It’s important to consider a group of probabilistic outcomes of these events along with combinations of the good and bad factors to aid decision-making.

1. MINING

Mining profitability is a huge contributor to the rise and especially the fall of the ETH price. The higher the price of ETH, the more miners are attracted to mine it. The more they mine, the more transactions can occur. For a miner to be incentivized, the profit obtained from mining Ethereum would have to offset the cost of mining by far.

When the price of ETH is high, compared to what it once was, mining profitability increases and miners sell their Ether. When the price is low, it’s the other way around, miners hold onto their Ether, increasing the demand and in turn the price.

2. REGULATIONS

The cryptocurrency market has gone wildly unregulated for a long time. This lack of regulation has caused the occurrence of several incidents, which would be illegal in any other markets to occur. Incidents like the case of BitConnect, pump and dump schemes, the case of MtGox and the Modern Tech ICO are some examples.

However, some countries have decided to crack down on cryptocurrency trade by putting several regulations in place to limit and even ban some aspects of cryptocurrency trading. One example is the ICO ban by China. While these regulations serve to limit scams and money loss, some of them have negatively affected the prices of certain cryptocurrencies including Ethereum.

It’s no surprise that the platform may stand to lose the most from regulations due to its unique functionality of having applications built on it. These regulations stand to limit the way users interact with DApps, smart contracts, and Ether as a whole.

In May 2018, Ethereum experienced a 6% decline when the Wall Street Journal announced that it had come under the SEC’s regulatory scrutiny. When the SEC declared both Ethereum and Bitcoin as non-securities in June 2018, the market saw a huge boost. One appeal of cryptocurrency is that it’s not policed by any government. If that changes, there’s no telling what disastrous effects it will have on the value of the coin.

WHO ACCEPTS ETHEREUM?

Currently, Ethereum is accepted by a few businesses to fund their decentralized applications. It’s also accepted on most major exchanges because users constantly buy and sell their Ether. As the platform expands and more individuals and businesses create and use DApps and smart contracts, acceptance of ETH will become more mainstream. Here is a list of some small businesses that currently accept Ethereum.

- Cryptopets- A pet supply service that allows users to pay for supply and delivery using ETH

- Overstock- A home improvement retailer

- Flokinet- A Scandinavian web hosting company

- Tapjets- One of the largest private jet rentals in the U.S

- Snel- A popular VPS hosting service

Larger businesses can be found in the Enterprise Ethereum Alliance. The alliance consists of large companies that have decided to embrace Ethereum for different applications. Some members include Mastercard, Hewlett Packard, Microsoft, and J.P.Morgan.

ETHEREUM SUPPLY

The annual supply of ETH through minting (formerly mining) is capped at 18 million independent of the Ethereum exchange rate. While this may seem like an inflation problem waiting to happen, the Ethereum team has worked out why that’s not the case.

A certain percentage of Ether is lost annually through theft, lost private keys or even death. As Ethereum scales and becomes more economically acceptable, 18 million ETH will no longer seem like such a huge annual cap.

Eventually, the amount of Ether lost per year will match the amount minted and the system will remain balanced. When new blocks are minted, block rewards are paid out to the nodes responsible for minting. Those who receive the rewards sell them, depending on the ETH price, allowing more Ether to circulate. This influences the Ethereum exchange rate.

ETHEREUM NEWS

Ethereum has constantly been in the news since its release for several reasons, including updates and significant changes. Here are some relevant stories from current Ethereum blockchain news.

- In May 2018 – Vitalik Buterin Endorsed Liquidity network, a trustless payment service that will operate like PayPal. The project seeks to solve the scalability issues of blockchain starting with Ethereum.

- In June 2018 – Vitalik Buterin, the founder of Ethereum stated that the platform would soon be able to process up to 1 million transactions every second. The Ethereum community is looking into different solutions, including sharding, to combat the problem of transaction speed.

WHAT IS LITECOIN?

Litecoin is a peer-based cryptocurrency that was created to address some of the issues associated with the Bitcoin blockchain. These issues include transaction confirmation speed, scalability, mining process, and transaction fees. It was created by Charlie Lee, a Google developer at the time.

Lee was unimpressed with the wait time of 10 minutes or more that users have to endure when using Bitcoin. He set about working on his cryptocurrency by copying the Bitcoin open source software and making changes to it. In October 2011, Litecoin was released, and by November 2013, it had reached a market cap of $1 billion.

Litecoin is currently the sixth largest cryptocurrency by market cap after Bitcoin, Ethereum, Ripple, Bitcoin cash, and EOS. The value of its market cap currently lies at approximately $5.7 billion and its price is currently about $100, with a peak price of $375.29 in December 2017.

HOW DOES LITECOIN WORK?

Litecoin operates using blockchain technology, just like Bitcoin. While Litecoin is a separate entity from Bitcoin, the two cryptocurrencies work in very similar ways. However, their differences also play a significant role in the progression of Litecoin.

DIFFERENCES BETWEEN BITCOIN AND LITECOIN EXPLAINED

Initially, Litecoin was mainly created to solve the problem of transaction speed. On the Bitcoin blockchain, it takes roughly 10 minutes for miners to add a new block to the blockchain. Transactions on the platform cannot be confirmed without this mining process and in cases where there are any mining problems, users may have to endure an even longer wait time.

Litecoin, on the other hand, has a transaction speed of 2.5 minutes, which is better for several reasons. Firstly, merchants can now transact freely in four times the amount of time it would take with Bitcoin. Frequent micropayments can also be achieved using Litecoin because if one transaction takes 2.5 minutes then, theoretically, each person would be able to carry out over 500 transactions each day.

The transaction speed is also great for miners. Where Bitcoin mining power is controlled by a concentrated batch of people, Litecoin mining is more decentralized. Theoretically, the fast block confirmation time allows more miners to mine blocks and receive rewards. This leads to a better distribution of rewards.

Another difference between Bitcoin vs Litecoin is that while the former will only have 21 million tokens in existence, the latter will have 84 million. Due to the transaction confirmation time of 2.5 minutes, Litecoin blocks get mined four times faster than Bitcoin.

To make up for the speed and ensure the gradual progression of the system, the total supply of LTC is capped at four times that of BTC. Litecoin also has lower transaction fees than Bitcoin, making it easier to carry out several transactions on its blockchain. The average transaction fee is $0.108 with a median fee of $0.036.

LITECOIN BLOCKCHAIN

The Litecoin blockchain is a decentralized ledger just like that of Bitcoin and uses the proof-of-work system for mining new blocks. However, there are some fundamental differences in the Litecoin block explorer as well as the block mining process. First of all, while Bitcoin uses the SHA-256 hashing algorithm in its mining process, Litecoin uses Scrypt. This was an intentional move by Lee to make LTC mining a more decentralized process.

In Bitcoin mining, large devices known as ASIC can run code that solves mathematical puzzles at the same time. While ASIC provides immense computational power, it can be expensive, and for this reason, average individuals cannot mine BTC. Scrypt, on the other hand, is more serialized than SHA-256.

Running parallel operations will take up a vast amount of memory, so miners run them one after the other. This means that anyone with access to memory in the form of a memory card can mine LTC, ultimately making the process more decentralized.

The first mined block on Litecoin had a block reward of 50 LTC. This mining reward will be halved every 840,000 blocks. Transactions on the blockchain can be viewed using Blockcypher, the Litecoin blockchain explorer.

WHY INVEST IN LITECOIN?

The growth pattern of LTC has shown that investment in the cryptocurrency is better over a long-term period. While there is no assurance of a fast increase in LTC price any time soon, its community remains unfazed. LTC price predictions continue to flood the internet with varying opinions. In January 2017, 1 LTC had a value of $4, and by December of the same year, it had risen by more than 9,000% to a peak price of $375.29.

If a user had invested $5,000 in Litecoin in January 2017, then by December 2017, it would have increased to $469,112 at peak price. While this may sound like enough reason to pour money into Litecoin, it should be kept in mind that losses can occur as well. Users who bought LTC at a triple-digit price are currently facing those losses as LTC drops below $100 in what has been termed a “market correction.”

According to analysts and blockchain enthusiasts, the rapid drop in Litecoin price may signify an impending price explosion. If that is the case, then it would be reasonable to buy low and hold for a long time (maybe years). Even though the cryptocurrency is nowhere near Bitcoin in price, it continues to be a boon to investors.

WHO ACCEPTS LITECOIN

Litecoin isn’t as big as Bitcoin and Ethereum, so its adoption has been happening at a much slower pace. As the cryptocurrency gains more traction, its adoption as a means of payment is expected to grow as well. There are currently a few places that accept LTC.

- Benz and Beemer- An auto dealership

- eGifter- A New York-based gifting service

- Alza.cz- An online retailer

LITECOIN SUPPLY

Litecoin supply is received from the continuous release of LTC in the same way as Bitcoin. The currency has a current block reward of 25 LTC plus transaction fees which miners may choose to sell on the market. An increased Litecoin supply always pushes its price down and vice versa.

LITECOIN NEWS

Litecoin has also continued to make news headlines with its key updates. Here are a few relevant Litecoin blockchain news snippets.

- Dark web users have decided to drop Bitcoin as a form of payment because of the slow transaction speeds and other issues they’ve had to endure.

- December 2017- Charlie Lee, Litecoin founder, sells all his LTC in what many are calling a conflict of interest.

Now let’s compare the basics of all three cryptocurrencies.

BITCOIN VS ETHEREUM VS LITECOIN: BASICS

| Property | Bitcoin | Ethereum | Litecoin |

| Market Cap | $115.4 billion | $53.7 billion | $5.6 billion |

| Release Year | 2008 | 2015 | 2011 |

| Peak Price | ≅ $20,000 | ≅ $1,400 | ≅ $375 |

| Mining Process | Proof-of-Work with SHA-256 | Proof-of-Stake | Proof-of-Work with Scrypt |

| Block Explorer | blockchain.info, blockcypher.com, blockchair.com | Etherscan.io, ethplorer.io Etherchain.org, | explorer.Litecoin.net, chainz.cryptoid.info, blockcypher |

| Total Coin Supply | 21 million BTC | 18 million ETH per year | 84 million LTC |

| Transaction Fee | $1 | $2-$4 | $0.18 |

| Confirmation Time | 10 minutes | 20 seconds | 2.5 minutes |

BITCOIN VS ETHEREUM VS LITECOIN: PRICING

Whether a user is new to cryptocurrency or not, the whole exchange process can be very confusing. There are a lot of questions, such as Ethereum pass Bitcoin? Is Ethereum better than Bitcoin? How do you even go about exchanges? And, can you exchange one cryptocurrency for another like maybe Bitcoin for Litecoin and vice versa? Apart from questions like these, there are other technicalities like market analysis and coin-watching.

The best way to go about unbundling blockchain is by studying the facts and taking little steps. For pricing, the facts are simple when comparing Bitcoin vs Ethereum. The former had a price growth of about 1,000% while the latter grew by about 10,000%. Despite having a higher overall price, the figures show that Bitcoin may not be as good for investment as Ethereum. As for Bitcoin vs Litecoin, the same trend appears where the smaller cryptocurrency had a better price growth than Bitcoin.

Figuring out which of the cryptocurrencies is better will depend on the user’s preference. All three coins have shown potential to revolutionize investing in their different ways. However, one thing is clear: they all seem to yield better results from long-term investment. These days, anyone can make a Litecoin, Bitcoin or Ethereum price prediction. It’s important to weed out the ones that don’t show any true logic behind them before using them as an investment guideline.

Price-monitoring can be done on sites like Coinmarketcap to see the rise and fall of both the prices and a market cap of different coins. Exchanges like Binance also show current prices and allow users to exchange one cryptocurrency for another. It’s possible to exchange Bitcoin for Ethereum, Bitcoin for Litecoin and so on.

BITCOIN VS ETHEREUM VS LITECOIN: WALLETS

All three cryptocurrencies use similar wallets. Mobile, desktop, web and hardware wallets are acceptable on their platforms. The safest option is hardware wallets because they’re offline and can’t be hacked. Such wallets can be stored in a safety deposit box or even a vault at home depending on the value of their contents.

BITCOIN VS ETHEREUM VS LITECOIN: MINING

For those looking to understand and perform cryptocurrency mining, there are significant differences between the way Bitcoin, Ether and Litecoin are mined. Bitcoin mining uses the SHA-256 hashing method to ensure that miners solve a challenging puzzle. They show a solution known as the proof-of-work and add new blocks to the blockchain after. The current block reward is about 12.5 BTC valued at almost $83,000.

Ethereum, on the other hand, switched from the proof-of-work to the proof-of-stake method in which new blocks are minted, not mined. In proof-of-stake, a node puts up an amount of its personal Ether as a stake. The node with the highest stake is chosen to validate the next block. Validators bet on blocks to show that they don’t have any malicious transactions on them. If a malicious block is validated, the validators lose their stake. However, if the block isn’t malicious, then the validator gets a reward proportional to their bet.

Litecoin mining also involves the proof-of-work protocol like Bitcoin. However, Scrypt is used in place of SHA-256 to mitigate the problems associated with mining centralization and energy use. Scrypt allows any user with access to extra memory to become a miner without buying expensive ASIC devices like Bitcoin miners. The current Litecoin block reward is 25 LTC valued at about $2,500 at the time of writing.

CONCLUSION

Cryptocurrency is relatively new and is still being studied and continuously improved upon. Market experiments are still occurring, and businesses continue to find new ways to accept blockchain technology. This is evident in the fast growth of platforms like Ethereum, the Enterprise Ethereum Alliance and recent partnerships like that of sites like Pornhub and Verge cryptocurrency.

While this may sound exciting, investors should not get too carried away as there are many ways to lose money in crypto investing. Research the market and how it constantly changes while leaving room for unpredictable outcomes. Although the field of cryptocurrency is still quite young, Bitcoin, Ethereum, and Litecoin have earned their places as giants that continue to drive innovation in one way or the other.

Article First Appeared on MintDice

Professional freelancer and webmaster.

Hey! Guys, I would suggest checking this coolest Bitcoin casino called TrustDice: https://trustdice.win Check it now! 🙂