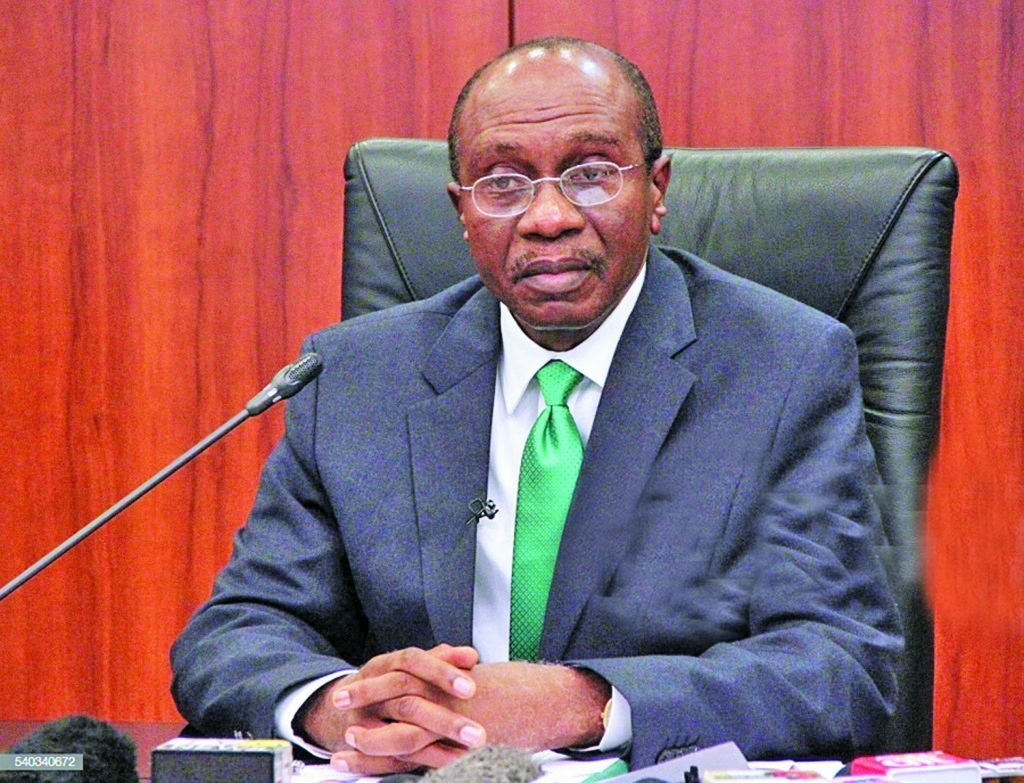

CBN’s Six-initial Policy to Combat Coronavirus Scourge.

Central Bank of Nigeria (CBN) Monday cut interest rates on all applicable CBN’s intervention facilities from nine to five per cent per annum for one year effective March 1, 2020 and also granted a further moratorium of one year on all principal repayments.

The apex bank also created a N50 billion facility through the NIRSAL Microfinance Bank for households and small- and medium-sized enterprises (SMEs) that have been particularly hard hit by Coronavirus-19 (COVID-19), including but not limited to hoteliers, airline service providers, health care merchants, etc.

CBN explained that it acted in response to the Coronavirus pandemic which has devastated the global economy creating unprecedented disruptions in global supply chains, sharp reduction in crude oil prices, turmoil in global stock and financial markets.

“All CBN intervention facilities are hereby granted a further moratorium of one year on all principal repayments, effective March 1, 2020. This means that any intervention loan currently under moratorium are hereby granted additional period of one year.

“Accordingly, participating financial institutions are hereby directed to provide new amortisation schedules for all beneficiaries,” CBN said.

HERE IS A COPY OF THE CIRCULAR

CBN’s Six-initial Policy to Combat Coronavirus Scourge.

Kindly follow us on social media to get trending updates as they come.

Have something to add to this story? Please share it in the comments box.

Follow us on Facebook, Instagram & Twitter to keep up to date with

trending news as it happens.

NEXT READ: 10 Solid Business to Start in your Bedroom with Little or no Capital – Abel Wealth

Discover more from TOKTOK9JA MEDIA

Subscribe to get the latest posts sent to your email.